Investing in rental properties can be a lucrative venture, but determining the value of a rental property is crucial for making informed decisions. Understanding how to calculate this value helps investors maximize their return on investment and build a sustainable business. This guide will delve into the methods of calculating a rental property’s value, the responsibilities of property managers, and how to build a property management budget.

Understanding Property Value

Before diving into the calculations, it’s important to understand what makes a rental property valuable. The value of a rental property is influenced by various factors, including location, property condition, market trends, and income potential. Accurately assessing these factors ensures you make sound investment decisions.

Methods to Calculate Rental Property Value

1. Comparable Sales Method (Comparative Market Analysis)

The Comparable Sales Method involves evaluating the prices of similar properties recently sold in the same area. This method provides a baseline value based on current market trends. To use this method, identify properties with similar features, such as size, age, and condition. Analyze their sale prices to estimate your property’s value.

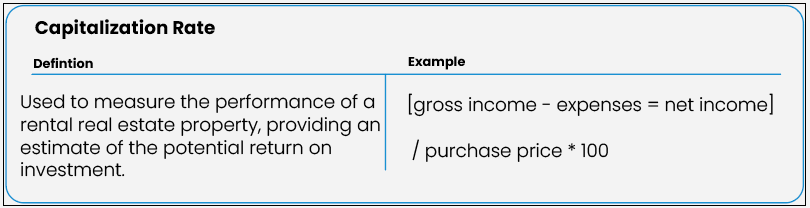

2. Income Approach (Capitalization Rate)

The Income Approach values a property based on its potential to generate income. This method is particularly useful for rental properties. The key metric here is the capitalization rate (cap rate), which is the ratio of the property’s net operating income (NOI) to its current market value or purchase price.

To calculate NOI, subtract operating expenses (excluding mortgage payments) from the gross rental income. The formula is:

NOI= Gross Rental Income – Operations expenses

Once you have the NOI and cap rate, you can estimate the property’s value:

Property Value = NOI/ Cap Rate

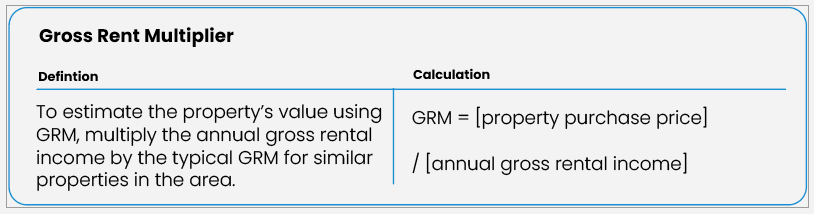

3. Gross Rent Multiplier (GRM)

The Gross Rent Multiplier is a simple method that uses the property’s gross rental income to estimate its value. The formula is:

To find the property value, rearrange the formula:

Property Value = Annual gross rental income * GRM

This method provides a quick estimate but doesn’t account for operating expenses.

Responsibilities of Property Managers

Effective property management is essential for maintaining and increasing the value of rental properties. Property managers handle a variety of tasks, including:

- Resident Management: Marketing vacancies, screening residents, handling leases, and resolving resident issues are crucial for maintaining high occupancy rates and resident satisfaction.

- Maintenance and Repairs: Coordinating routine maintenance, emergency repairs, and renovations ensures the property remains in good condition and retains its value.

- Financial Management: Property managers set rental rates, collect rent, and manage the property’s budget. They also prepare financial statements and handle accounting tasks.

- Legal Compliance: Ensuring the property adheres to local, state, and federal regulations, including fair housing laws and safety codes, is critical to avoid legal issues.

- Vendor Management: Negotiating contracts with various vendors, overseeing their work, and ensuring high-quality services are part of a property manager’s responsibilities.

How to Build a Property Management Budget

A well-structured property management budget is vital for financial stability and maximizing your return on investment. Here’s a step-by-step guide to building an effective budget:

- List All Potential Expenses: Start by listing all possible expenses, both fixed and variable. Include categories such as marketing, resident screening, maintenance, property management fees, utilities, insurance, legal and accounting fees, and administrative costs.

- Estimate Costs: For each expense category, estimate the costs based on historical data, industry standards, and market research. Be realistic and include a buffer for unexpected costs.

- Prioritize and Allocate Funds: Prioritize essential expenses like maintenance and legal fees. Allocate funds accordingly to cover all critical areas.

- Set Rental Rates Strategically: Your rental income should cover your expenses and leave room for profit. Set rental rates based on market research, property value, and the level of service you provide.

- Monitor and Adjust: Regularly review your budget, compare it with actual expenses, and adjust as necessary. This ongoing process helps you stay on top of your financial health.

- Use Property Management Software: Leverage technology to streamline your budgeting process. Property management software can help track expenses, generate reports, and provide insights to improve your financial planning.

Calculating the value of a rental property is a crucial step in making informed investment decisions. By understanding different valuation methods, such as the Comparable Sales Method, Income Approach, and Gross Rent Multiplier, you can accurately assess a property’s worth. Additionally, recognizing the responsibilities of property managers and building a comprehensive property management budget are key to maintaining and enhancing the value of your rental properties.

Whether you’re a seasoned investor or new to the rental property market, these insights will help you navigate the complexities of property valuation and management with confidence. By staying proactive and informed, you can maximize your return on investment and build a successful rental property business.