How to Build a Property Management Budget

Table of Contents

Building a property management budget is a critical task for property managers and owners alike. A well-crafted budget ensures that all property management expenses are accounted for, providing a roadmap for financial planning and decision-making. This guide will walk you through the steps to build a comprehensive property management budget, including key considerations such as property management expenses, how a property management company is compensated, and how to calculate the value of a rental property. All of these elements tie into the overarching topic of understanding the responsibilities of property managers.

Understanding Property Management Expenses

The first step in building a property management budget is to identify and categorize all property management expenses. These can be broadly divided into fixed and variable costs.

Fixed Expenses

Fixed expenses are costs that remain constant regardless of occupancy or other factors. These include:

- Mortgage Payments: If the property is financed, monthly mortgage payments are a significant fixed expense.

- Property Taxes: Annual property taxes must be paid regardless of occupancy rates.

- Insurance: Property insurance, including liability and hazard insurance, is essential for protecting the investment.

- Property Management Fees: If using a property management company, their fees are typically a fixed percentage of rental income.

Variable Expenses

Variable expenses fluctuate based on factors such as occupancy, property condition, and maintenance needs. These include:

- Maintenance and Repairs: Regular maintenance and unexpected repairs can vary widely.

- Utilities: Costs for water, electricity, gas, and other utilities can change based on usage and occupancy.

- Marketing and Advertising: Expenses for listing properties and attracting residents can vary based on market conditions.

- Resident Turnover Costs: Cleaning, repairs, and marketing costs associated with resident turnover can fluctuate.

Reserve Fund

It’s also important to allocate a portion of the budget to a reserve fund for unexpected expenses or major repairs. This ensures that there are funds available for emergencies without disrupting the overall budget.

How is a Property Management Company Compensated?

Understanding how a property management company is compensated is crucial for both property owners and managers when building a budget. Compensation structures can vary, but they generally include the following components:

Percentage of Rental Income

The most common method of compensation is a percentage of the monthly rental income. This fee typically ranges from 8% to 12% of the collected rent. This fee covers the basic management services, including resident screening, rent collection, and maintenance coordination.

Leasing Fees

In addition to the monthly management fee, property management companies often charge a leasing fee when a new resident is placed. This fee can be a flat rate or a percentage of the first month’s rent and covers the costs of advertising, showing the property, and processing applications.

Maintenance Fees

Some property management companies charge additional fees for coordinating maintenance and repairs. These fees can be a percentage of the total repair cost or a flat fee per service call.

Renewal Fees

A renewal fee may be charged when a resident renews their lease. This fee compensates the property management company for negotiating and processing the lease renewal.

Miscellaneous Fees

Other potential fees include eviction fees, administrative fees, and setup fees for new properties. It’s important to clearly understand all potential fees and include them in the budget.

How to Calculate the Value of a Rental Property

Accurately calculating the value of a rental property is essential for setting rental rates, planning for expenses, and evaluating the property’s performance. Several methods can be used to determine a property’s value, including:

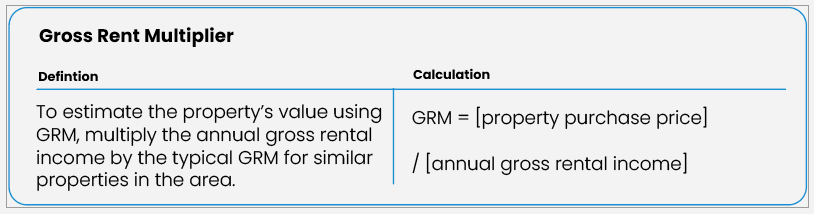

Gross Rent Multiplier (GRM)

The Gross Rent Multiplier is a simple method to estimate a property’s value based on its rental income. The GRM is calculated by dividing the property’s purchase price by its annual gross rental income.

To estimate the property’s value using GRM, multiply the annual gross rental income by the typical GRM for similar properties in the area.

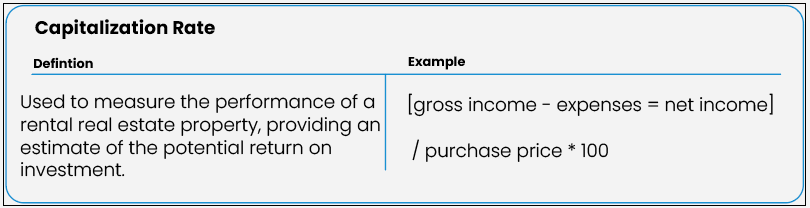

Capitalization Rate (Cap Rate)

The capitalization rate measures the property’s annual net operating income (NOI) as a percentage of its purchase price. The Cap Rate is calculated as:

NOI is calculated by subtracting operating expenses (excluding mortgage payments) from the gross rental income. A higher Cap Rate indicates a potentially more profitable investment.

Comparable Sales Approach

The comparable sales approach involves comparing the property to similar properties that have recently sold in the area. Adjustments are made for differences in size, condition, location, and amenities. This method provides a market-based estimate of the property’s value.

Income Approach

The income approach estimates the property’s value based on its ability to generate income. This method involves forecasting future rental income, subtracting operating expenses, and applying a capitalization rate to determine the property’s present value.

Responsibilities of Property Managers

Property managers have a broad range of responsibilities that directly impact the financial performance of rental properties. These responsibilities include:

Financial Management

Property managers are responsible for managing the property’s finances, including setting rental rates, collecting rent, and preparing financial statements. Building and adhering to a detailed budget is a critical component of this responsibility.

Maintenance and Repairs

Ensuring the property is well-maintained and addressing repairs promptly is essential for preserving the property’s value and keeping residents satisfied. Property managers must coordinate regular maintenance, handle emergency repairs, and manage vendor relationships.

Resident Relations

Maintaining positive relationships with residents is crucial for reducing turnover and ensuring timely rent payments. Property managers are responsible for resident screening, lease administration, and addressing resident concerns.

Legal Compliance

Property managers must ensure the property complies with all local, state, and federal laws, including housing codes, landlord-resident laws, and fair housing regulations. This includes handling evictions legally and efficiently when necessary.

Marketing and Leasing

Effective marketing and leasing strategies are vital for minimizing vacancies and attracting quality residents. Property managers must create compelling listings, conduct property showings, and process rental applications.

Risk Management

Identifying and mitigating risks is a key responsibility of property managers. This includes ensuring adequate insurance coverage, conducting regular property inspections, and implementing safety protocols.

Building a Comprehensive Property Management Budget

With a clear understanding of property management expenses, compensation structures, and the responsibilities of property managers, it’s time to build a comprehensive property management budget. Here are the steps to follow:

Step 1: Estimate Income

Start by estimating the property’s rental income. Consider current rental rates, occupancy rates, and any additional income sources such as parking fees, laundry facilities, or storage rentals.

Step 2: List Fixed Expenses

Identify all fixed expenses, including mortgage payments, property taxes, insurance, and property management fees. These costs remain constant regardless of occupancy or other factors.

Step 3: Project Variable Expenses

Estimate variable expenses based on historical data and industry benchmarks. Include maintenance and repair costs, utilities, marketing expenses, and resident turnover costs. It’s important to be realistic and account for seasonal fluctuations.

Step 4: Allocate a Reserve Fund

Set aside a portion of the budget for a reserve fund to cover unexpected expenses or major repairs. A general rule of thumb is to allocate 5% to 10% of the property’s gross rental income to the reserve fund.

Step 5: Factor in Property Management Compensation

Include all property management fees in the budget, including the percentage of rental income, leasing fees, maintenance fees, and any other miscellaneous fees. Ensure you have a clear understanding of the property management company’s compensation structure.

Step 6: Calculate Net Operating Income (NOI)

Subtract all operating expenses (fixed, variable, and reserve fund allocations) from the estimated rental income to calculate the property’s Net Operating Income (NOI). This provides a snapshot of the property’s profitability before debt service and taxes.

Step 7: Plan for Capital Expenditures

Consider any planned capital expenditures, such as major renovations or upgrades. These costs are typically not included in the operating budget but should be planned for separately.

Step 8: Review and Adjust

Review the budget regularly and adjust as needed based on actual performance and changing circumstances. A flexible budget allows property managers to respond to unexpected challenges and opportunities effectively.

Building a comprehensive property management budget is a fundamental responsibility of property managers. By accurately estimating income, identifying and categorizing expenses, and planning for contingencies, property managers can ensure the financial health and profitability of rental properties. Understanding the compensation structure of property management companies and accurately calculating the value of rental properties are also crucial components of this process.

Ultimately, a well-crafted budget enables property managers to fulfill their responsibilities to property owners, ensuring that their investments are protected and profitable. By adopting a proactive and detailed approach to budgeting, property managers can navigate the complexities of property management with confidence and success.