It is harder to hang on to investors than ever before. This is largely due to the changing economy. There has been a major power shift largely due to the housing shortage and influx of money into the consumer market. Now residents have more power and property managers have to work harder to lower their vacancy rates and lower their time on market.

Lease renewals are protecting rent prices. New leases are creating rent compression. Meaning the more you can renew leases you are able to increase profits. The more churn you have, leads to rent compression and profit loss.

How Does Maintenance Influence Investor Churn?

In the dynamic world of property investment, understanding the correlation between maintenance and investor churn is crucial. Maintenance spend stands out as a significant factor influencing investor churn rates. Research indicates that when maintenance spend exceeds 12% of the rent roll, investor churn rates tend to escalate.

Moreover, resident satisfaction plays a pivotal role in this equation. Property management companies boasting high resident satisfaction are markedly more adept at retaining investors compared to those receiving poor resident reviews.

It’s no surprise that unsatisfactory maintenance experiences rank among the leading causes prompting residents to terminate leases, second only to rent increases.

For investors, the priorities are clear: managing maintenance costs effectively and retaining tenants. However, achieving these objectives has become increasingly challenging in today’s evolving rental market landscape. Understanding and addressing the interplay between maintenance and investor churn is imperative for property managers navigating these complexities.

How Can You Combat Investor Churn?

The best way to combat investor churn is to understand leading and lagging indicators for maintenance. Once you understand these indicators it is much easier to reach a predictable NOI for your investors.

Using these metrics you can determine what is causing certain issues. For example, you may find out that you have an incredibly slow investor approval speed which is hurting your investor retention because repair speeds are increasing.

18 months ago the industry was heavily focused on resident satisfaction and scalability. Now as the economy has shifted, so has the focus of property management companies. Property managers are focusing on metrics like annual maintenance spend per unit, their vendor network health, technician utilization rates, and resident renewals. Everything now is centered around cost management and reducing churn.

As we have studied this at Property Meld we have noticed some new trends. There has been a huge spike in remote team members. Additionally, centralization has become a cost management tool. Multi-markets are condensing resources to maximize personnel. This has led to an increase in more departmental operations, to provide more consistent and predictable outcomes. A lot more property management companies are bringing on internal tech teams to be able to analyze performance.

Lastly, and perhaps the most important, leading property managers are relying on data to show the value they bring to their investors. This facilitates more enriching conversations and allows you to tell the story to investors.

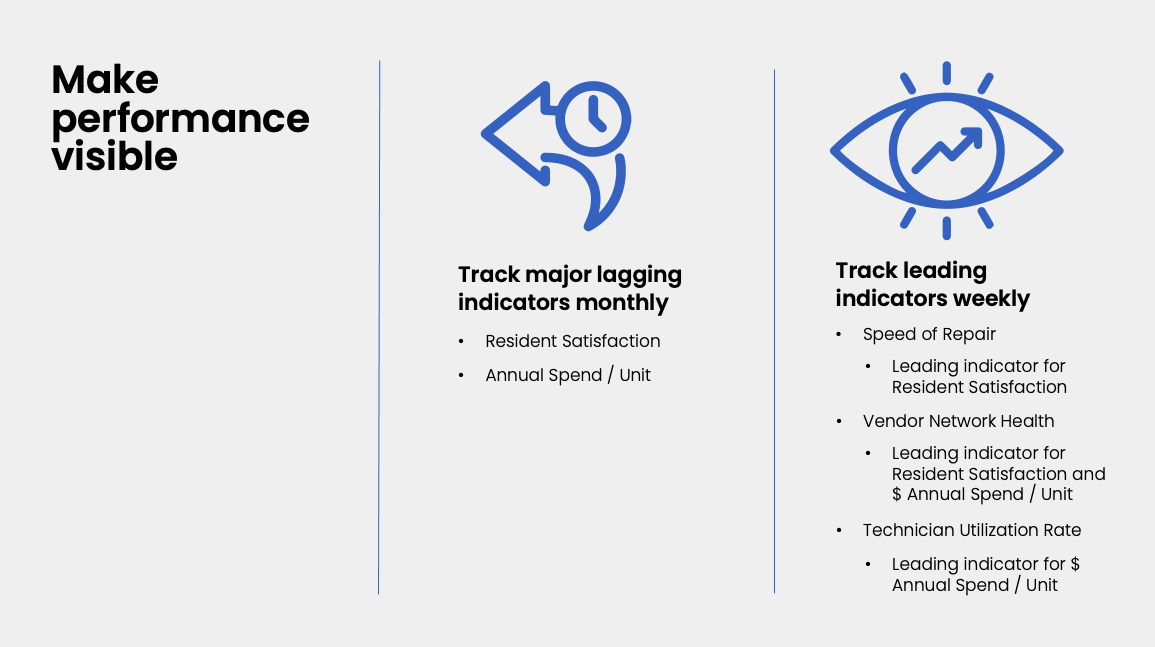

Make Performance Visible

When it comes to maintenance you have to make performance visible. You can do this by tracking your major lagging indicators monthly, things like resident satisfaction and annual spend/unit should be tracked monthly. Leading indicators like speed of repair, vendor network health, and technician utilization rate should be tracked on a weekly basis. This allows you to keep a strong focus on what may be impacting your renewal rates, and start fixing problems before they grow into larger issues.

Having these conversations regularly can make maintenance a more positive experience and be able to celebrate what they are doing right.

To see what the industry benchmarks are for some of the data points discussed in this presentation download our KPI Cheat Sheet.