Why is it important to keep residents happy with the way you handle business? The more residents that renew leases, the more profitable your business. Consistent profitability is one of the best ways to retain your current property investors and attract new owners to grow your portfolio. In this article, we’ll dissect how resident satisfaction impacts investor retention, shedding light on why keeping residents happy is a strategic imperative for property owners looking to secure their investments.

Top 2 Ways to Measure Resident Satisfaction?

Understanding how to measure resident satisfaction is paramount for ensuring the smooth functioning and long-term viability of real estate investments.

- Implement regular surveys tailored to capture residents’ feedback on various aspects of their living experience, including maintenance responsiveness, common area upkeep, and overall satisfaction with property management services.

- Leverage technology such as property maintenance software can streamline the feedback process, allowing for efficient data collection and analysis. Furthermore, tracking metrics such as maintenance request response times and resident turnover rates provides valuable insights into resident satisfaction levels and areas for improvement.

By adopting a multifaceted approach to measuring resident satisfaction, property owners and managers can proactively address concerns, enhance resident experiences, and ultimately bolster investor retention.

Property Meld provides a best-in-class resident experience to enhance resident satisfaction. Our software sends automatic surveys to all residents upon the completion of their work order so you can evaluate your maintenance process. Additionally, you can track the performance of internal technicians and vendors to ensure they are providing the level of service you expect.

Property Meld customers boast 4.9 out of 5 stars, directly helping them reduce turnover and improve investor retention.

What Are Leading and Lagging Indicators for Property Investor Retention?

Leading indicators are predictive metrics or signals that precede changes in a particular phenomenon, providing insight into future trends or outcomes. In the context of property management and investment, leading indicators may include early signs of resident dissatisfaction, such as an increase in maintenance requests or a decline in Net Promoter Scores (NPS). By identifying leading indicators, property owners and managers can anticipate potential challenges or opportunities, allowing for proactive decision-making and strategic interventions to mitigate risks or capitalize on emerging trends.

Lagging indicators are retrospective metrics that follow changes in a given phenomenon, reflecting past performance or outcomes. In the realm of property management and investment, lagging indicators may encompass metrics such as resident turnover rates, online reviews, or financial performance metrics like return on investment (ROI). While lagging indicators provide valuable insights into historical trends and outcomes, they often indicate the consequences of earlier actions or decisions. By monitoring lagging indicators, property stakeholders can assess the effectiveness of past strategies, identify areas for improvement, and make informed decisions to optimize future performance.

Leading Indicators for Investor Retention:

- Communication per Work Order:

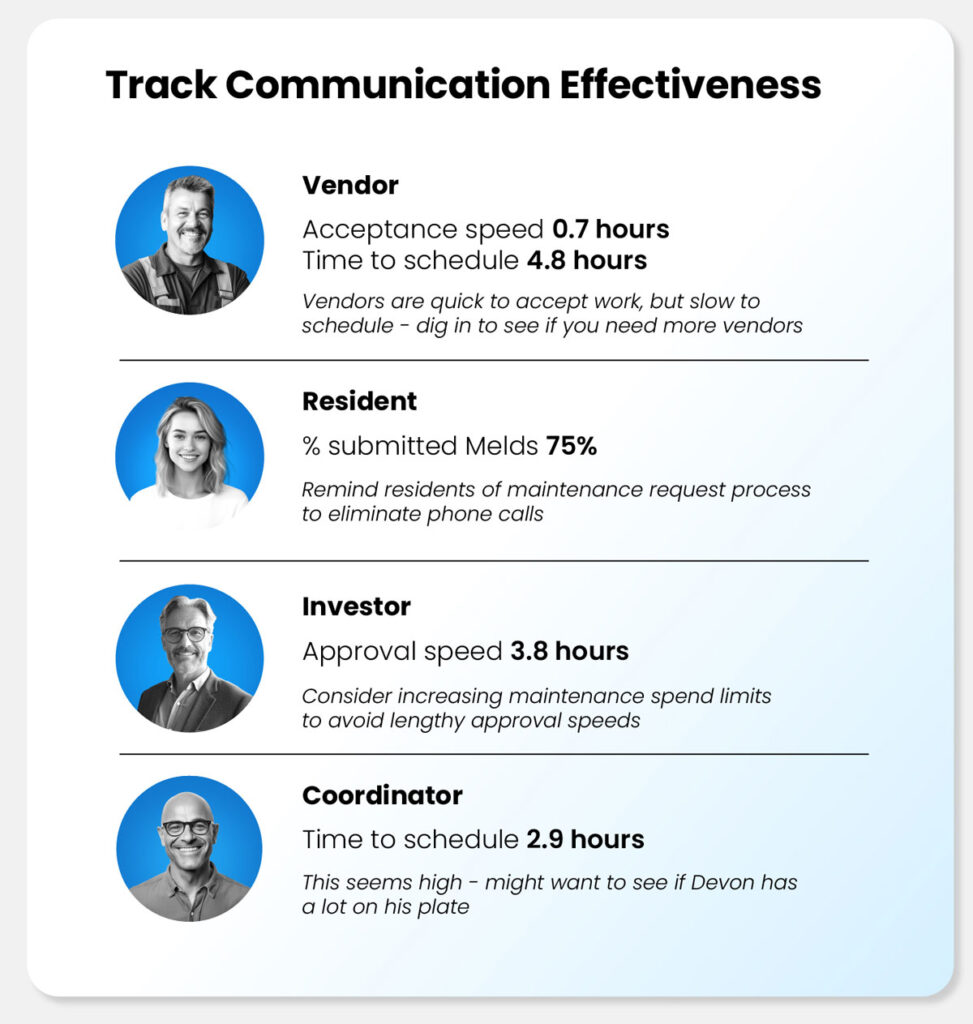

Measuring the number of interactions between residents, property management teams, technicians, and vendors provides valuable insights into the efficiency of your maintenance processes. This metric serves as a leading indicator of repair speed, reflecting the level of engagement and collaboration among stakeholders throughout the maintenance lifecycle.

- Resident-Submitted Work Orders:

The percentage of work orders initiated by residents offers another perspective on repair speeds. It indicates residents’ familiarity with the maintenance process and ensures their active participation in addressing maintenance issues promptly, thereby enhancing overall responsiveness.

- Repair Speed:

The speed at which repairs are completed stands as a crucial leading indicator of resident satisfaction and lease renewals. Any decline in repair speed could signal potential dissatisfaction among residents, posing risks of future turnover among renters and investors alike.

- Annual Maintenance Cost per Unit:

Understanding the relationship between annual maintenance expenditure and property unit is essential for predicting investor churn. Investors prioritize achieving a positive Net Operating Income (NOI), and any significant increase in maintenance costs exceeding 12% of the rent roll may escalate churn risk substantially.

The Importance of Resident Satisfaction as a Lagging Indicator of Investor Retention

Resident satisfaction serves as a pivotal lagging indicator of investor retention due to its direct correlation with long-term property performance and financial stability. While leading indicators offer valuable insights into potential challenges or opportunities, it’s the retrospective analysis of resident satisfaction that truly reflects the health of an investment. Here’s why resident satisfaction stands out as the most crucial lagging indicator of investor retention:

1. Reflection of Overall Property Health:

Resident satisfaction encapsulates various aspects of the resident experience, including property management responsiveness, maintenance quality, and community amenities. As a lagging indicator, it provides a comprehensive overview of how well the property is meeting residents’ needs and expectations over time. A high level of resident satisfaction typically indicates a well-managed property with satisfied residents, contributing to positive investor retention.

2. Impact on Lease Renewals and resident Turnover:

Lagging indicators such as lease renewal rates and resident turnover directly reflect the satisfaction levels of residents during their stay. A high rate of lease renewals suggests that residents are content with their living experience and are likely to stay longer, providing consistent rental income for investors. Conversely, frequent resident turnover often indicates dissatisfaction among residents, leading to increased vacancy rates and turnover costs, ultimately impacting investor retention negatively.

3. Influence on Property Reputation and Market Perception:

Residents’ experiences and satisfaction levels contribute significantly to a property’s reputation within the market. Positive word-of-mouth referrals and online reviews from satisfied residents enhance the property’s desirability, attracting new residents and investors alike. Conversely, negative feedback and low satisfaction levels can tarnish the property’s reputation, making it less appealing to prospective residents and investors, thereby affecting investor retention in the long run.

4. Alignment with Investor Goals and Financial Objectives:

Ultimately, investor retention hinges on achieving financial objectives and maximizing returns on investment. Resident satisfaction directly influences key financial metrics such as rental income, occupancy rates, and Net Operating Income (NOI). Properties with consistently high resident satisfaction tend to perform better financially, attracting and retaining investors seeking stable and lucrative investment opportunities.

While leading indicators offer valuable insights into potential issues, resident satisfaction stands out as the most crucial lagging indicator of investor retention. By prioritizing resident satisfaction, property owners and managers can foster a positive living environment, enhance property performance, and ultimately secure long-term investor loyalty and retention.

Improving resident satisfaction in the context of the maintenance process is crucial for fostering trust and loyalty.

Here are 5 targeted strategies to enhance resident satisfaction:

1. Streamlined Maintenance Requests:

Implement a user-friendly platform or app, like Property Meld, for residents to submit maintenance requests efficiently. Streamlining the process reduces friction and ensures prompt resolution of issues, leading to higher satisfaction levels.

2. Timely Response and Resolution:

Commit to timely response and resolution of maintenance requests by leveraging technology for tracking and prioritizing tasks. Residents appreciate swift action when addressing maintenance issues, contributing to their overall satisfaction with the property.

3. Quality Service:

Partner with skilled and reliable maintenance technicians or contractors to ensure high-quality workmanship. Investing in competent professionals who deliver consistent results not only resolves issues effectively but also instills confidence in residents regarding the property management’s commitment to their well-being.

4. Transparent Communication:

Keep residents informed throughout the maintenance process by providing updates on request status, anticipated timelines, and any potential disruptions. Transparent communication builds trust and reduces uncertainty, fostering positive perceptions of the property management’s responsiveness and accountability.

5. Feedback Loop:

Establish a feedback loop where residents can provide input on their maintenance experiences, whether through surveys, follow-up calls, or in-person interactions. Actively soliciting feedback demonstrates a commitment to continuous improvement and allows property management to address any recurring issues or areas for enhancement, ultimately enhancing resident satisfaction with the maintenance process.

Improving resident satisfaction in the context of the maintenance process is crucial for fostering trust and loyalty.