As property managers kick off 2024, property management companies across the United States focus on investor retention. According to data from the 2024 Property Management Industry Report by Buildium this will be a main focus for property management companies this year. It is projected that the rental market will get increasingly more competitive as vacancy rates shift and reputation matters, retaining your investors is critical to profitability and long-term success.

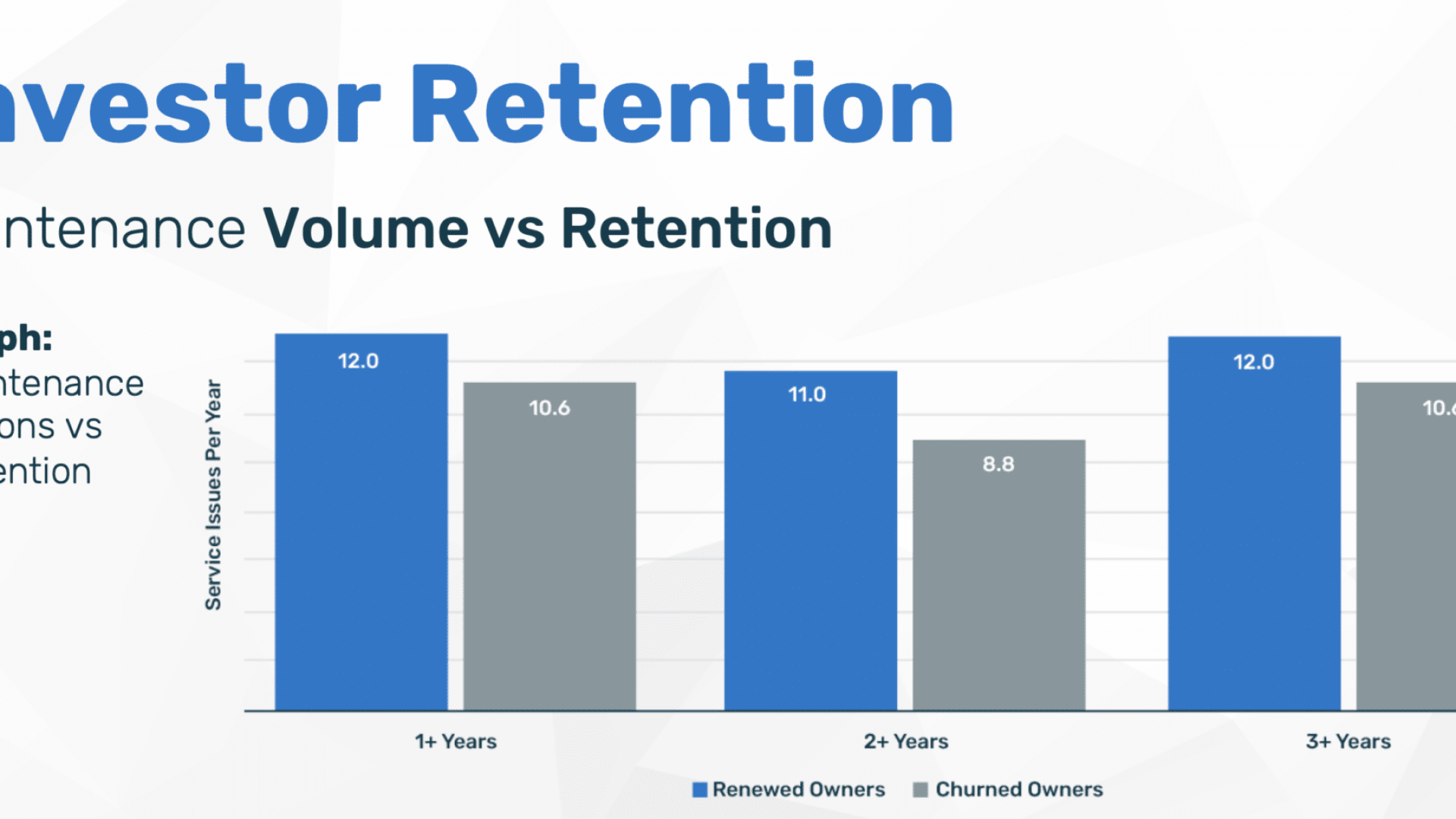

The success of your maintenance process plays a crucial role in keeping your investors. Speed of repair, or the length of time it takes for a completed request, directly impacts resident satisfaction. It goes without saying, the more residents you lose, the more money you lose in vacancies. In result, the more money you lose, the higher the probability of investor turnover.

Besides focusing on improving your repair speeds and keeping residents happy, one of the best ways to increase investor retention is to lower the overall cost of maintenance.

Investors care about two things:

1: Their properties are well taken care of.

2: Maximizing their return on investments.

It’s important to remember that cutting down on maintenance won’t solve your problem. Neglecting maintenance issues will lead to larger, more expensive repairs down the line. The goal is to find ways to become more efficient and productive so you can complete the same repairs at a lower cost to investors.

Property Maintenance Spend and Investor Retention

Property maintenance has a massive impact on investor retention because maintenance is one of the most unpredictable aspects of property management. If you fail to run a successful maintenance program, maintenance costs can get out of hand quickly. Data shows that 31% of residents decide to leave a property due to poor maintenance practices. If your residents are churning, you will see your investor churn start to follow suit.

Well-maintained properties attract and retain quality residents. If you prioritize maintenance, your residents will be happier with the rental experience and more likely to renew their lease. Lease renewals ensure a steady stream of income for your investors. Units sitting vacant can mean thousands of dollars lost in revenue, not to mention the costs associated with rental turnovers. If you can provide a better rental experience and increase renewals, you will likely see a direct correlation to investor retention.

Most property management companies send out monthly statements to their investors highlighting costs and profits. If, month after month, your investors are bombarded with costly repairs, they will start to grow uneasy in your relationship and may look to other property management companies they think will give them a better return on their investment (ROI). The current industry standard for annual maintenance spend per unit is between $1,680 – $2,592. If your spend is way below or above this number, or even worse, you don’t have visibility into your maintenance spend, you’re more than likely struggling with investor retention. Many property investors compare different companies based on their financial performance. If you demonstrate cost-effectiveness, you will stand out against other companies in your area.

How Can I Track My Annual Maintenance Spend?

Investors are more likely to retain their investments with property management companies prioritizing maintenance. It directly impacts the long-term sustainability of their assets. If they ever want to sell their properties, a well-maintained property has a much higher resale value, meaning your investors can get a better price for their investments when they are ready to sell.

In summary, property maintenance plays a pivotal role in investor retention by preserving asset value, ensuring resident satisfaction, maintaining market competitiveness, promoting financial stability, mitigating risks, supporting long-term sustainability, building a positive reputation, enhancing resale value, and contributing to a higher return on investment. Investors are more likely to retain their investments in properties where maintenance is a priority, as it directly impacts the overall performance and value of the investment.

Investing in property maintenance software is the best way to ensure you prioritize maintenance and drive down costs. Property Meld empowers property management companies to lower maintenance spend by implementing preventative maintenance strategies. Our comprehensive maintenance dashboard also lets you track annual spending per unit. This metric allows you to determine when repair costs are most expensive and make strategic plans to avoid paying inflated labor and parts costs.

Importance of Investor Retention

Investor retention is crucial to a property management company for several reasons:

1: Stability and Predictability:

Retaining investors provides stability and predictability in revenue streams. A consistent base of investors ensures a steady income for the property management company, allowing for better financial planning and management.

2: Long-Term Relationships:

Building and maintaining long-term relationships with investors fosters trust and loyalty. Repeat business from satisfied investors is more cost-effective than constantly acquiring new clients, saving on marketing and acquisition expenses.

3: Referrals and Recommendations:

Satisfied investors are more likely to refer the property management company to others. Positive word-of-mouth referrals and recommendations can attract new investors, contributing to the company’s growth and success.

4: Reduced Vacancy Rates:

Effective property management practices contribute to resident satisfaction, reducing vacancy rates. Investors appreciate property managers who can consistently attract and retain quality residents, ensuring a stable rental income.

5: Positive Reputation:

A track record of successful property management and satisfied investors builds a positive reputation in the industry. A reputable property management company is more likely to attract new investors and retain existing ones.

6: Efficient Operations:

Retained investors are familiar with the property management company’s operations, reducing the need for extensive onboarding and training for new clients. This familiarity leads to more efficient and streamlined processes.

7: Economies of Scale:

Managing a portfolio of properties for retained investors allows the property management company to benefit from economies of scale. Streamlined operations and bulk services can lead to cost savings, improving overall profitability.

8: Cross-Selling Opportunities:

A property management company that retains investors may have opportunities to cross-sell additional services, such as property acquisition, portfolio expansion, or real estate consulting. This diversification can contribute to increased revenue.

9: Adaptability to Investor Needs:

Over time, a property management company develops a deeper understanding of the specific needs and preferences of its retained investors. This knowledge allows the company to tailor its services to better meet investor expectations.

10: Financial Health and Sustainability:

A stable and growing investor base contributes to the financial health and sustainability of the property management company. Consistent revenue from retained investors provides a solid foundation for ongoing business operations.

In summary, investor retention is crucial for the financial stability, growth, and reputation of a property management company. It not only ensures a steady income but also opens doors to new business opportunities, referrals, and operational efficiencies. Building and maintaining strong relationships with investors contribute to the long-term success of the property management business.

In fact, research shows that a property management company overseeing 500 units or more has the potential to increase profits by $840,000 just by keeping an investor for five years as opposed to three. If you could increase the Lifetime Value (LTV) of each and every investor, think how much more you could make in profits.

How Does Resident Turnover Impact Investor Retention

A lot of property management companies aren’t prioritizing resident satisfaction in 2024 and it’s a big mistake. First, industry data shows that resident retention is one of the key focuses for 2024 as we are moving into a renter’s led market. Failing to prioritize resident satisfaction will lead to rental churn and rental churn leads to owner churn.

Resident turnover can have many direct impacts on investor retention for a property management company. Here’s how:

1: Vacancy Losses:

High resident turnover often leads to increased vacancy periods between renters. Vacancy losses can reduce rental income and negatively affect the property’s overall financial performance. Investors may be concerned about income fluctuations and the potential impact on their returns.

2: Increased Operating Costs:

Every turnover involves costs related to advertising, resident screening, property maintenance, and potential repairs or upgrades. Frequent turnover increases these operating costs, reducing the overall profitability of the property. Investors may become dissatisfied with the increased expenses.

3: Quality Concerns:

Frequent turnover may raise concerns about the quality of residents attracted to the property. Investors prefer stable, responsible renters who pay rent on time and take care of the property. High turnover rates may signal difficulties in resident management, affecting investor confidence.

4: Impact on Property Value:

Continuous turnover and vacancies can negatively impact the perceived value of the property. Investors often consider the property’s market value when assessing their investment, and frequent turnover may raise questions about the property’s attractiveness to renters and potential buyers.

5: Maintenance and Repair Costs:

Turnovers often require maintenance and repairs to prepare the property for new residents. Investors may be concerned about the impact of these recurring costs on their overall return on investment, especially if turnover is frequent.

6: Resident Satisfaction:

High turnover rates can indicate dissatisfaction among residents, whether due to management issues, property conditions, or other factors. Investors are likely to be concerned if renter dissatisfaction becomes a recurring problem, as it may impact the property’s long-term performance.

7: Investor Communication:

Property management companies often need to communicate with investors during turnover periods. Frequent turnovers may lead to increased communication regarding vacancies, which could become a source of frustration for investors. Clear and transparent communication becomes crucial during such times.

8: Market Perception:

The market perception of a property with frequent turnover may impact its attractiveness to potential investors. If the property is perceived as unstable or less desirable due to high turnover, it may affect the property management company’s ability to attract new investors and retain existing ones.

To mitigate the negative impact of resident turnover on investor retention, property management companies should focus on effective resident retention strategies, ensuring resident satisfaction, and minimizing vacancy periods. Clear communication with investors about turnover-related challenges and proactive measures taken to address them can also help maintain investor confidence.

Customers using Property Meld have an average resident satisfaction score of 4.2 – 4.6 (out of 5). Our platform was originally designed to offer a better maintenance experience to residents, reducing frustration and unnecessary turnover. Property Meld has over 90% resident adoption rate and is the number one resident preferred maintenance software in North America.

Why Is It Crucial To Lower Maintenance Costs?

Maintenance is one of the least optimized yet most significant opportunities for profitability in property management. Finding ways to increase your productivity and efficiency can help you save money on labor costs. As we have mentioned many times, lowering maintenance costs is crucial for building trust with investors and increasing retention, but there are many other benefits to lowering your maintenance costs.

Improved Cash Flow: Lower maintenance costs lead to improved cash flow for property management companies. Consistent positive cash flow is essential for meeting ongoing operational expenses and ensuring financial stability. It also allows for better planning and investment in growth opportunities.

Competitive Advantage: Property management is a competitive industry. Companies that can offer cost-effective solutions to property maintenance gain a competitive advantage. Investors are more likely to choose a property management company that demonstrates the ability to control and reduce maintenance expenses.

Long-Term Sustainability: Sustainable property management practices, including efficient maintenance spending, contribute to the long-term sustainability of the company. By avoiding unnecessary expenses and adopting cost-effective maintenance approaches, property management companies can ensure their continued success in the industry.

Resident Satisfaction: Efficient maintenance practices contribute to resident satisfaction. Satisfied residents are more likely to stay, reducing turnover costs and ensuring a stable rental income. This, in turn, positively impacts the property management company’s financial performance.

Enhancing Property Value: Well-maintained properties retain their value and may even appreciate over time. By efficiently managing maintenance costs, property management companies contribute to the overall preservation and enhancement of the properties they manage. This, in turn, positively impacts the property’s market value.

How Can I Lower Maintenance Costs?

Lowering maintenance costs in property management requires a strategic and proactive approach. Here are some effective ways to achieve this:

1: Preventive Maintenance Programs:

– Implement regular preventive maintenance schedules to address potential issues before they become costly problems.

– Conduct routine inspections to identify and address maintenance needs early on.

2: Vendor Negotiations:

– Negotiate competitive rates with maintenance vendors and suppliers.

– Consider long-term contracts or partnerships with vendors for bulk discounts.

3: In-House Maintenance Teams:

– Consider having an in-house maintenance team for routine tasks and minor repairs.

– This can reduce reliance on external contractors for every maintenance issue.

4: Energy-Efficient Upgrades:

– Invest in energy-efficient appliances and systems to reduce long-term maintenance needs.

– Energy-efficient upgrades may qualify for incentives or tax benefits.

5: Resident Education:

– Educate residents on proper property care and maintenance responsibilities.

– Encourage reporting of issues promptly to address them before they escalate.

6: Technology Integration:

– Implement property management software for streamlined maintenance tracking and scheduling.

– Use smart technology for monitoring and managing property systems efficiently.

7: Bulk Purchases:

– Purchase maintenance supplies in bulk to take advantage of volume discounts.

– Centralize purchasing to ensure cost-effective procurement.

8: Benchmarking and Analysis:

– Analyze historical maintenance data to identify patterns and trends.

– Benchmark against industry standards to assess the efficiency of maintenance spending.

9: Training and Certification:

– Ensure maintenance staff is well-trained and certified in relevant areas.

– Competent staff can address issues more efficiently, reducing the need for external contractors.

10: Emergency Preparedness:

– Develop emergency preparedness plans to minimize damage during unforeseen events.

– Swift responses can prevent extensive and costly repairs.

11: Long-Term Planning:

– Develop a long-term maintenance plan that considers the life cycle of property components.

– Prioritize and budget for major repairs and replacements in advance.

12: Regular Communication:

– Maintain open communication with residents to address issues promptly.

– Proactive communication can prevent minor problems from escalating.

13: Continuous Improvement:

– Regularly review and assess maintenance processes for areas of improvement.

– Seek feedback from residents and staff to identify opportunities to enhance efficiency.

Implementing a combination of these strategies tailored to your specific property portfolio can contribute to significant reductions in maintenance costs over time. Regularly reassess and adjust your approach based on evolving needs and industry trends.

Our team of maintenance professionals can show you how Property Meld helped our customers build more efficient, cost effective maintenance strategies.

To continue learning about this topic, download our guide “3 Reasons Owners Churn”. This guide will delve deeper into the causes of investor churn and educate you on how you can profit from better retention.