Blog

Get ready for an event like no other! Whether you’re a seasoned alumnus or a first-time attendee, the 2024 MX Summit, happening September 18-20, is packed with dynamic sessions, unparalleled networking opportunities, cutting-edge maintenance strategies, and inspiring keynote speakers that you can’t miss. For four consecutive years, the MX Summit has been the go-to conference […]

...Recent Posts

Investing in rental properties can be a lucrative venture, but determining the value of a rental property is crucial for making informed decisions. Understanding how to calculate this value helps...

Hiring a property management company can be a game-changer for landlords and real estate investors. These professionals handle the day-to-day operations, ensuring that everything runs smoothly and efficiently. But how...

Filter all posts

Investing in rental properties can be a lucrative venture, but determining the value of a rental property is crucial for making informed decisions. Understanding how to calculate this value helps...

Hiring a property management company can be a game-changer for landlords and real estate investors. These professionals handle the day-to-day operations, ensuring that everything runs smoothly and efficiently. But how...

When diving into the world of property management, it’s crucial to understand the various expenses involved. Whether you’re a seasoned landlord or new to the game, comprehending these costs helps...

How to Build a Property Management Budget Table of Contents Building a property management budget is a critical task for property managers and owners alike. A well-crafted budget ensures that...

In the competitive world of property management, balancing the need for high quality service with cost efficiency is paramount. One of the key areas where property managers can make a...

The success of rental properties hinges on more than just filling vacancies. The ongoing care and upkeep of these properties are vital to maintaining their value and ensuring resident satisfaction....

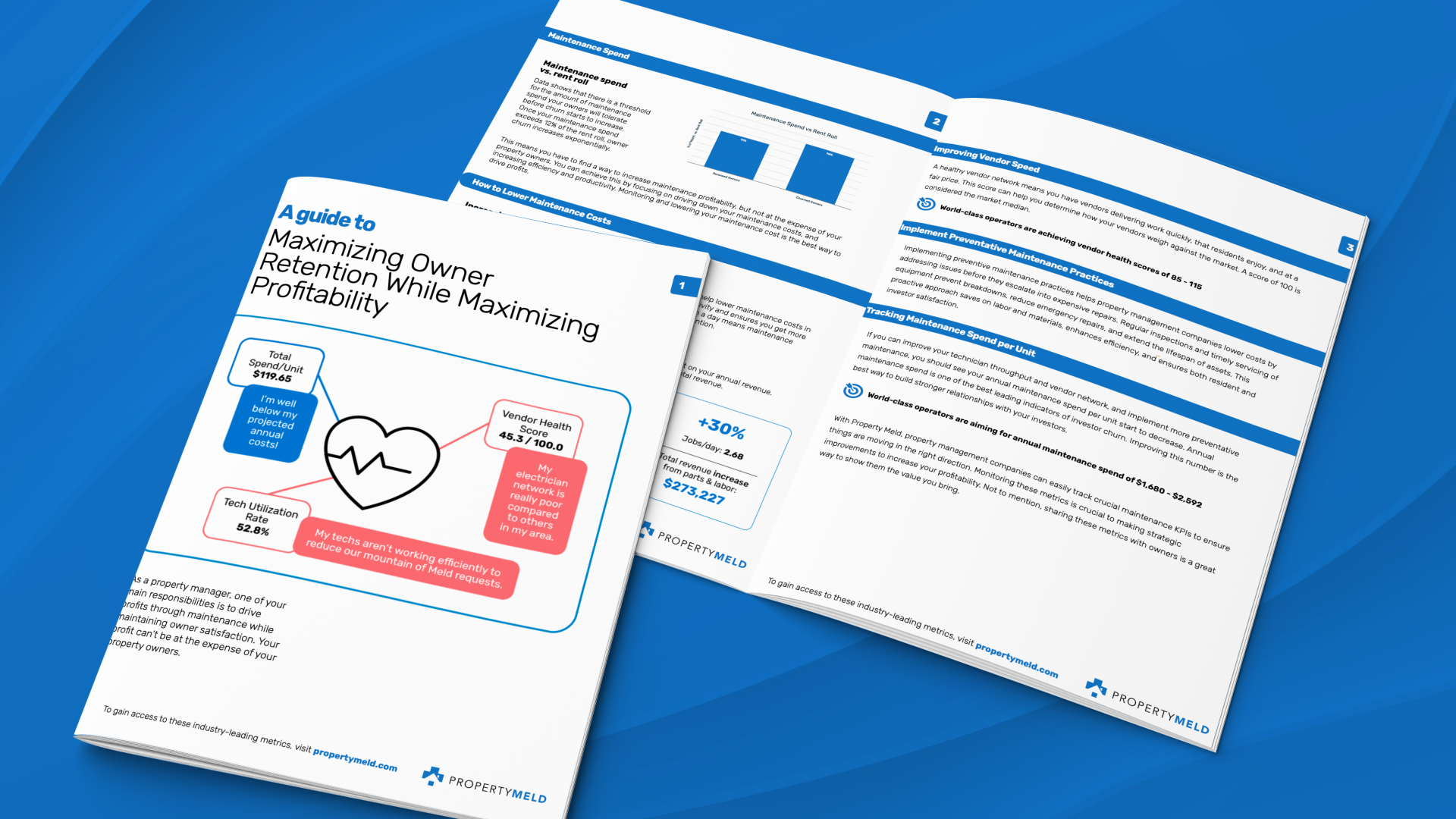

Property investors interested in increasing their NOI entrust property managers with the crucial task of maintaining their investments and ensuring profitability. At the core of a property manager’s responsibility to...

What is a Property Manager’s Main Responsibility to Their Owners? Table of Contents Property management is a multifaceted job that requires a blend of strategic planning, effective communication, and hands-on...

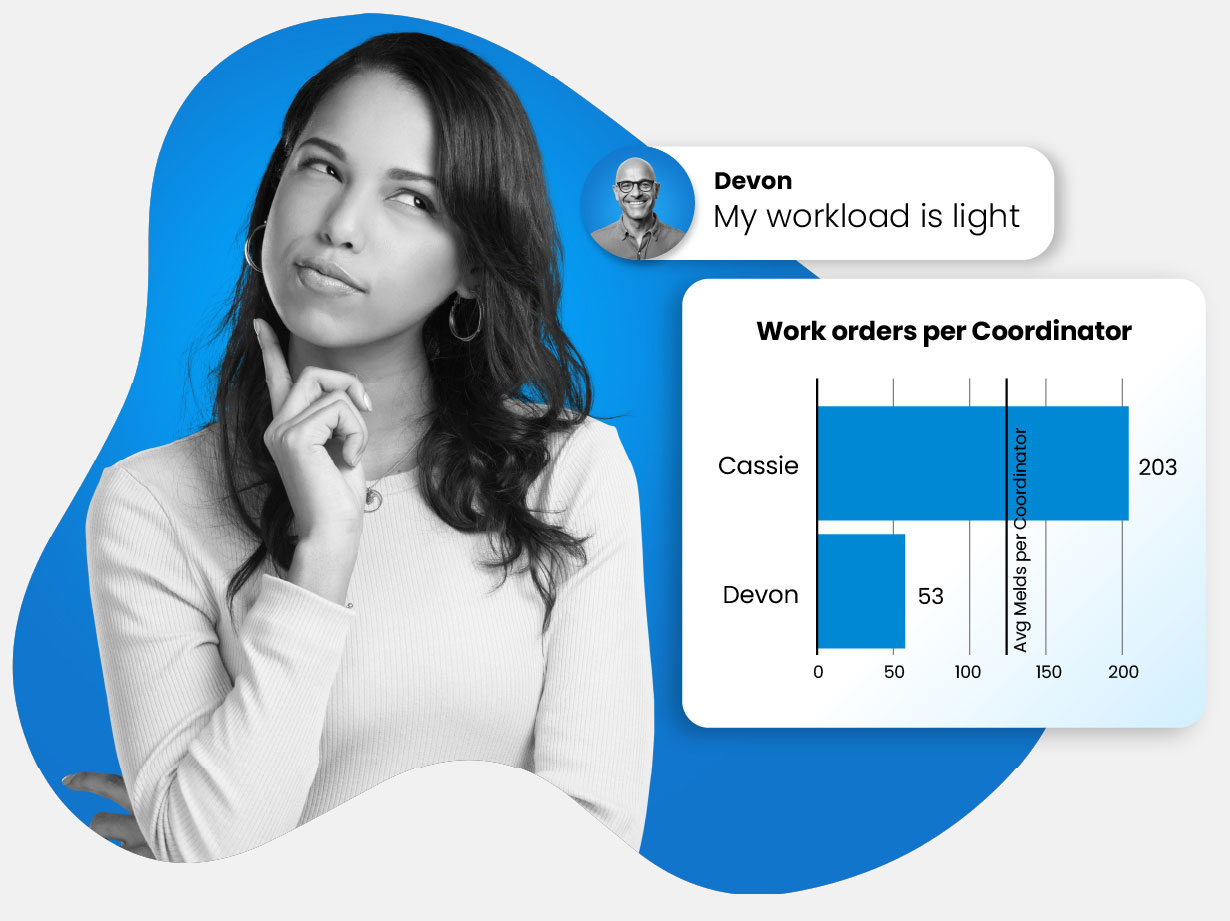

In the ever-evolving world of property management, efficiency is paramount to success. Property managers wear many hats, from handling resident requests to ensuring timely repairs. The sheer volume of responsibilities...

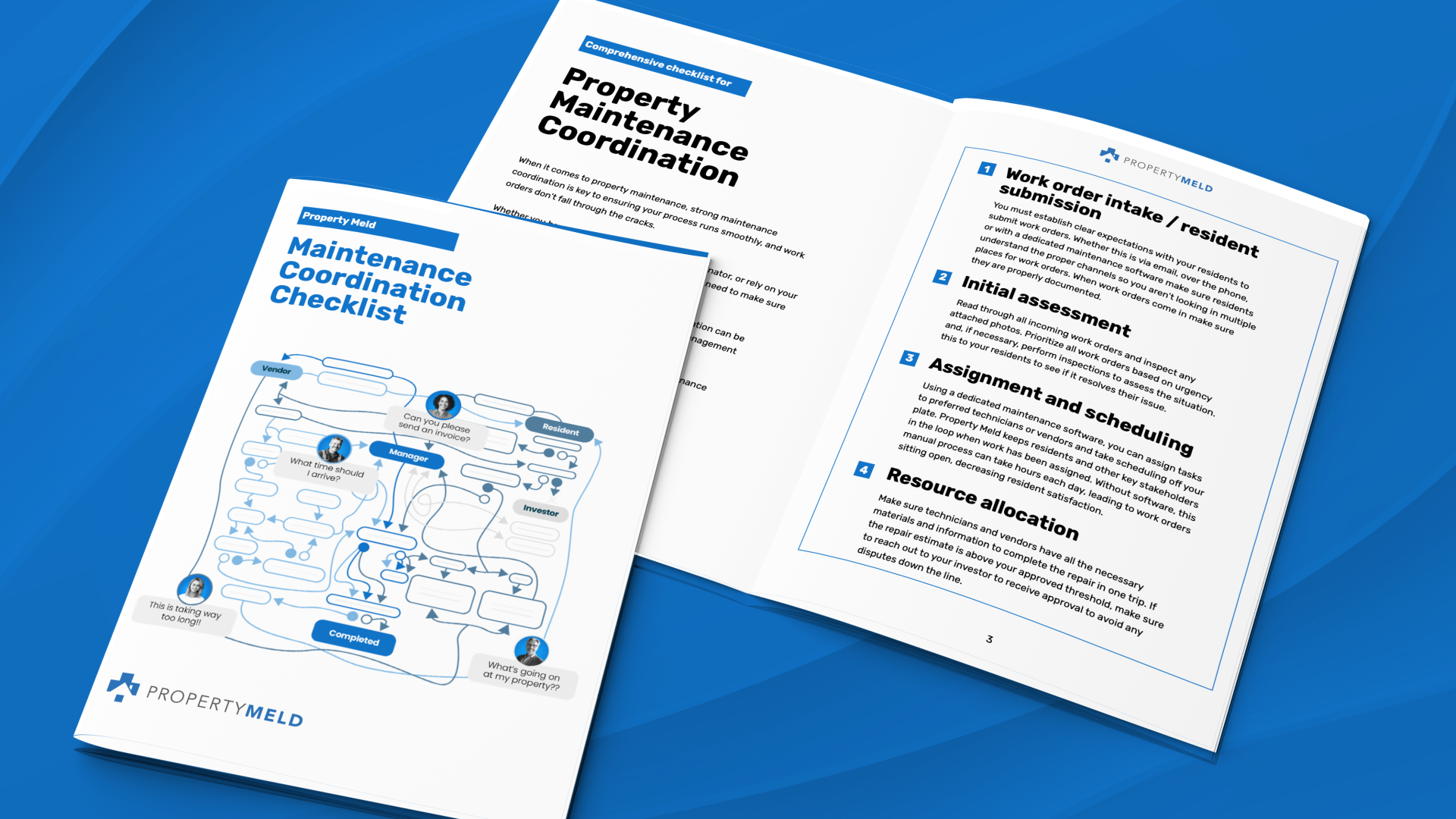

The Benefits of Work Order Scheduling Software In the bustling world of property management, efficiency is key. From coordinating maintenance requests to ensuring timely repairs, property managers juggle numerous tasks...

Property Maintenance Guide for Property Managers Table of Contents Property maintenance is one of the core responsibilities of property managers. It involves ensuring that the property is in good condition,...

What Are the Responsibilities of Property Managers Table of Contents Property managers play a vital role in the property management industry. They act as the bridge between property owners and...

We get it—keeping your properties in tip-top shape while ensuring profitability and owner satisfaction can feel like walking a tightrope. But here’s the secret: you can drive profits through maintenance...

On June 26, 2024, Property Meld hosted a webinar with LeadSimple titled “From Process Pains to Profit Gains.” The session featured insightful discussions on change management strategies and best practices...

Are you knee-deep in maintenance coordination checklists this time of year, manually juggling work orders, and crossing your fingers that communication between residents and vendors goes smoothly? It’s a scenario...

Get ready for an event like no other! Whether you’re a seasoned alumnus or a first-time attendee, the 2024 MX Summit, happening September 18-20, is packed with dynamic sessions, unparalleled...

According to industry data, 76% of institutional investors expect their property management companies to utilize technology in their operations. Implementing a robust tech stack is no longer the exception but...

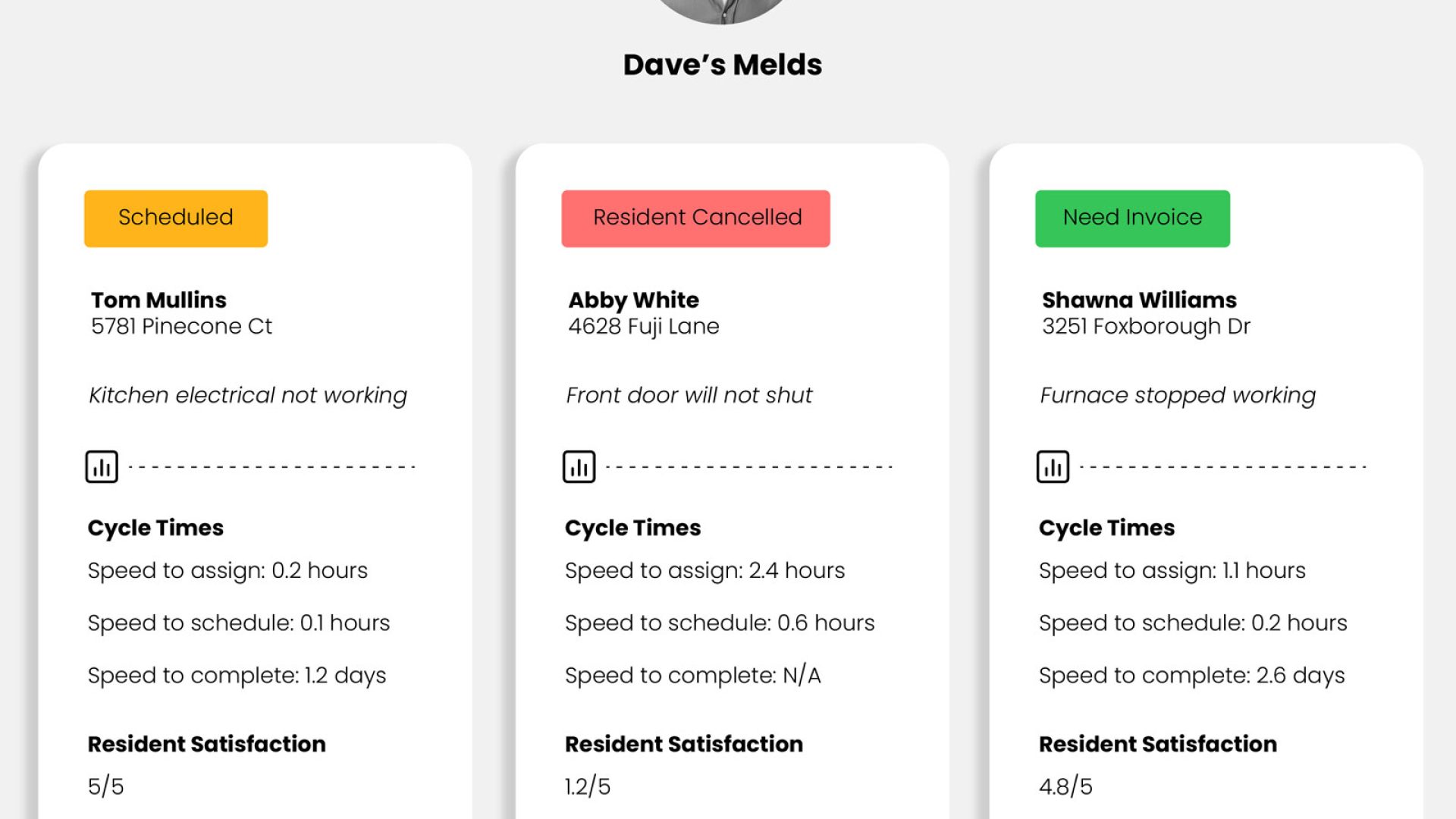

In property management, knowing how to measure resident satisfaction is paramount for fostering long-term resident relationships and maximizing investor returns. Property managers are tasked with juggling numerous responsibilities, from maintenance...